modified business tax return instructions

General Instructions Purpose of Form Use Form 4562 to. Line 18 Addition to Tax.

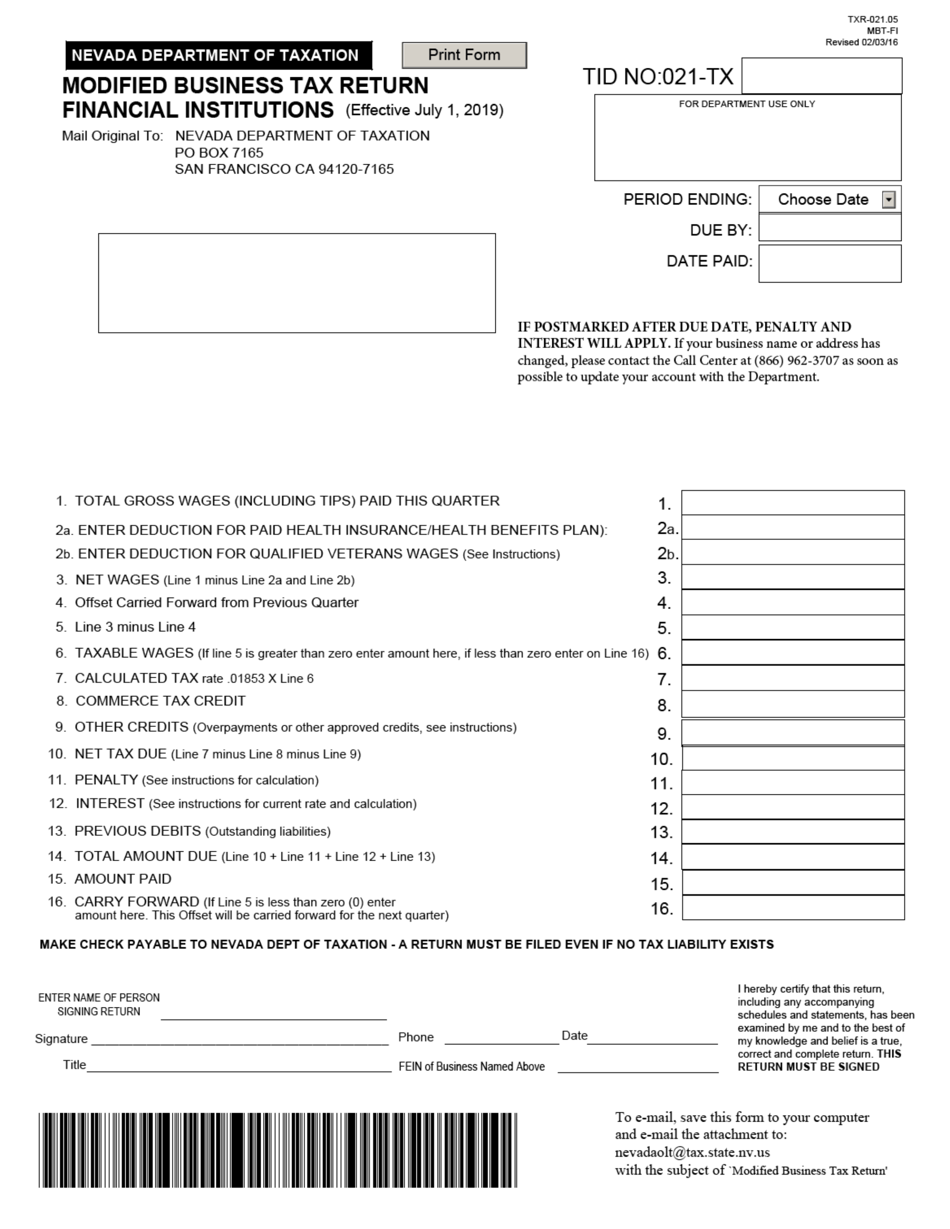

Form Txr 021 05 Mbt Fi Download Fillable Pdf Or Fill Online Modified Business Tax Return Financial Institutions Nevada Templateroller

However with our preconfigured web templates things get simpler.

. Claim your deduction for depreciation and amortization Make the election under section 179 to expense. The partnership must provide nonresident partners a. Who Must File Attach Form 8960 to your return if your modified adjusted gross.

Modified Business Tax Return-Financial Institutions 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for Financial. CARRY FORWARD If Line 5 is less. Follow the step-by-step instructions below to design your nevada form modified business.

Select the document you want to sign and click Upload. Total gross wages are the total amount of all gross. Understanding the Nevada Modified Business Return and Tax Form.

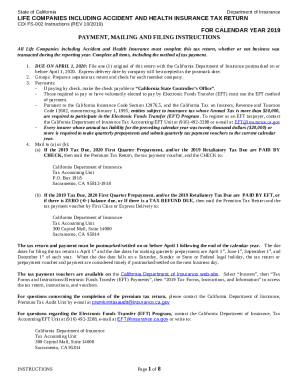

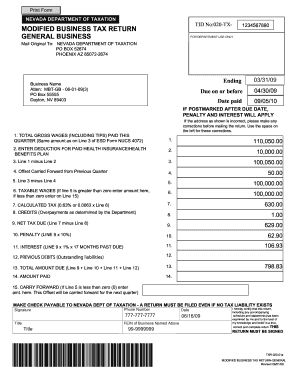

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY - Use this form only for the quarterly filing period beginning July 1 2009 Financial Institutions need to. These instructions will help you complete your 2022 Fringe benefits tax FBT return. Include a copy of the original return 2.

As in most states ever employer subject t the states unemployment compensation law is subject to a Modified. Write the word AMENDED in black ink in the upper right-hand corner of the return. GENERAL INFORMATION GENERAL BUSINESSES MUST USE FORM TXR-020.

The modified business tax covers total gross wages less employee health care benefits paid by the employer. Follow the step-by-step instructions below to design your modified business tax nevada. Line-through the original figures in.

These instructions are based mostly on Regulations sections 11411-1 through 11411-10. 04 FINANCIAL INSTITUTIONS MUST USE FORM TXR-021. Facebook page opens in new window Twitter page opens in new window Pinterest page opens in new window Instagram page opens in new window.

Quick guide on how to complete nevada modified business tax return form. Select the document you want to sign and click Upload. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02105 IF.

If APTC was paid on your behalf or if APTC was not paid on your behalf but you wish to take the. The preparing of lawful papers can be costly and time-ingesting. Follow the simple instructions below.

Modified Adjusted Gross Income Magi Calculating And Using It

Income General Information Department Of Taxation

Qbi Deduction Frequently Asked Questions K1 Qbi Schedulec Schedulee Schedulef W2

Fillable Online Janie The Genie Answer Key Form Fax Email Print Pdffiller

1040 2021 Internal Revenue Service

A Guide To Changing Previously Filed Partnership Returns

1040 2021 Internal Revenue Service

Nevada Modified Business Tax Form Fill Out And Sign Printable Pdf Template Signnow

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation Ppt Download

Don T Leave Money On The Table Employee Retention Credit Modified And Extended

How To Win The Tax Game And Play Within Its Complex Rules The New York Times

2021 Tax Returns What S New On The 1040 Form This Year Kiplinger

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

What Is Form 1120s And How Do I File It Ask Gusto

2022 State Business Tax Climate Index Tax Foundation

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings