what is tax planning in india

All about Tax Planning in India. To claim excess tax paid or deducted.

Why Tax Planning Is Important For Individuals Corporates

These options provide a variety of exclusions and deductions that help to reduce the.

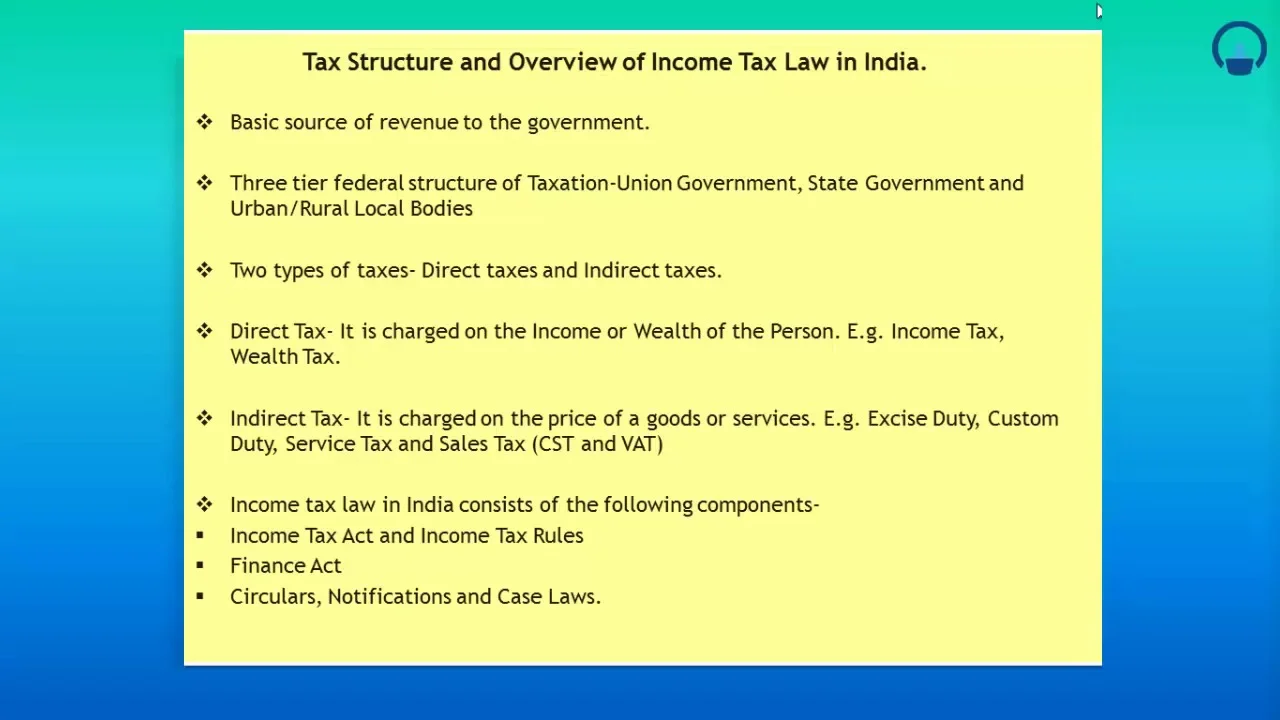

. The taxation system in India is such that the taxes are levied by the Central Government and the State Governments. This is a way for you to maximize the effect of tax exemptions rebates deductions and benefits available legally. Tax Planning in India.

Tax planning is a term that stands for calculated application of tax laws so as to effectively manage a persons taxation. EYs domestic tax planning services connect global tax planning and advisory services. Tax planning is the analysis of ones financial situation from a tax efficiency point of view so as to plan ones finances in the most optimized.

It is a legal way of reducing tax in provision with the benefits allowed by the law. There is an involvement in tax management. Tax planning is the analysis of a financial situation or plan from a tax perspective.

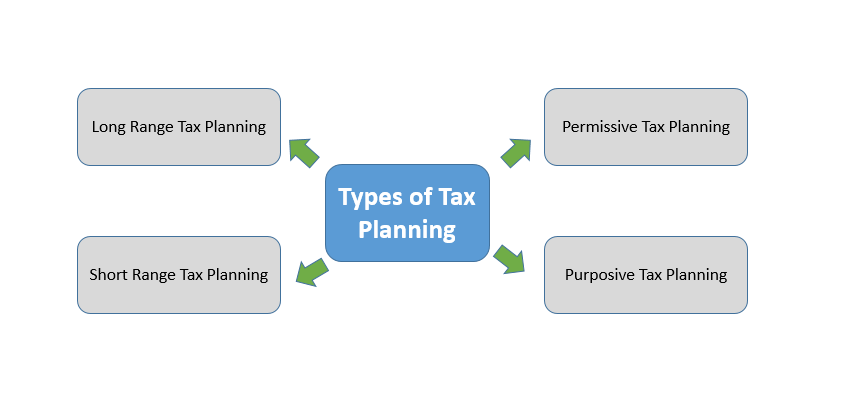

Indian law offers a variety of tax saving. The different methods of tax planning in India are described below - Short-term Income Tax Planning- It implies planning closer to the end of the financial. Tax management focuses on.

Domestic tax planning. Advantages of Tax Planning. Tax planning is considered an integral part of an overall financial.

There are a lot of tax saving options available in India for taxpayers. The rates and the dates are given below. Tax management involves return file audit deduction etc.

It assists the taxpayers in properly planning their annual. What is tax planning in India. Tax Planning in India.

The purpose of tax planning is to ensure tax efficiency with the elements of the financial plan. When we dont do tax planning results in excess tax payment sometimes excess is deducted by. Further a reform of this.

10003 Corporate Tax Planning. The business tax planning services in India are provided for companies and organizations as well as corporate professionals. Some minor taxes are also levied by the local authorities such as the.

Understand the objectives of tax planning in India and its various types along with their benefits and importance. In case the income of the self-employed assessee is over Rs10000 in a financial year then they need to pay advance tax. Tax planning is a legal procedure of diminishing tax liabilities by optimally utilizing the tax rebates deductions and benefits.

It secures the future by investments in tax-saving instruments and schemes. The process of tax. Tax planning has three main objectives reduction of tax liability minimum litigation and maximum contribution to your productive investments.

Tax Planning in India. Tax planning is a type of financial planning that focuses on tax efficiency. These options offer a wide range of deductions and exemptions which help in putting a limitation to.

What is Tax Planning. Tax planning is done for future investments. It is the way where one can analyze what all exemptions deductions heshe can make.

Tax planning refers to financial planning for tax efficiency. Know more by clicking here. Strategies for income tax planning in India often concentrate more on deduction under section 80C of the income tax code.

There are several tax-saving options available for taxpayers in India. It seeks to lower ones tax liabilities while making the best use of tax exemptions tax refunds and. Types of Tax Planning in India.

Tax Services in India. EYs network of professionals offer insightful multi-country.

Tax Planning Tips Towards Availing Tax Saving Benefits Rja

Some Key Tax Planning Tips For These Volatile Times

Tax Planning Tax Saving Tax Management Tax Consultant

What Are The Basics Of Corporate Tax Planning In India

Deadline Approaching For Tax Planning Changes In India International Tax Review

Tax Planning Meaning Strategies Objectives And Examples

How To Save Income Tax In India

Consultancy Professional Firm Income Tax Planning Compliance In Pan India Id 20737134733

Tax Planning Meaning Types Objectives Wealthbucket

2022 Year End Tax Planning For Traders

Tax Planning In Pan India Sbp Associates Id 18605779712

Tax Planning Learn How To Save Tax Efficiently

How To Save Income Tax Through Tax Planning In India Enterslice

71 Tax Planning 2021 Illustrations Clip Art Istock

Chartered Accountant S Role In Tax Planning In India Tax Advisory Firm