japan corporate tax rate 2018

Year Taxable Income Brackets Rates Notes. The business year is.

Japan Sales Tax Rate Consumption Tax 2022 Data 2023 Forecast

5 Starting Operations in Japan 2018 III Corporate tax considerations 1.

. Special local corporate tax rate is 4142 percent which is imposed on taxable income. Under tax laws in Japan there are six types of taxes levied on corporate income. The regular business tax rates vary between 03 and 14 depending on the.

Business year A business year is the period over which the profits and losses of a corporation are calculated. Income from 18000001 to 400000000. The ruling coalition the Liberal Democratic Party and the New Komeito on 14 December 2018 agreed to an outline of tax reform proposals that include corporate and.

2018 the corporate tax rate was. Historical Federal Corporate Income Tax Rates and Brackets 1909 to 2020. Please note that the personal exemptions shown.

Tax year beginning after. Income from 400000001 and above. Tax Rate applicable to fiscal years beginning between 1 April 2016 and 31 March 2018.

Due to a provision in the recently enacted Tax Cuts and Jobs Act TCJA a corporation with a fiscal year that includes January 1 2018 will pay federal income tax using a blended tax rate. The Corporate Tax Rate in Japan stands at 3086. The business year is.

A major feature of corporation tax is the tax rate. Gifts of over 250000 or about US4795 as of August 2019 will be taxed at a. Tax year beginning between 1 Apr 201631 Mar 2017.

The local standard corporate tax rate in. Income from sources in Japan during each business year. The Corporation Tax Rate in Japan.

Tax revenue of GDP in Japan was reported at 1191 in 2018 according to the World Bank collection of development indicators compiled from officially recognized sources. Rep Office If a foreign corporation operates in Japan through a Rep Office whose activities do not give rise to. 55 of taxable income.

Tax year beginning between 1 Apr 201731 Mar 2018. Jul 07 2020 Throughout 2018 and 2019 the Philippines imposed stricter tax guidelines on gifted money. Income from 9000001 to 18000000.

2018-2020 All taxable income. Corporate Tax Rate in Japan averaged 4296 percent from 1993 until 2016 reaching an all time high of 5240 percent. Japan Corporate Tax Rate was 3062 in 2022.

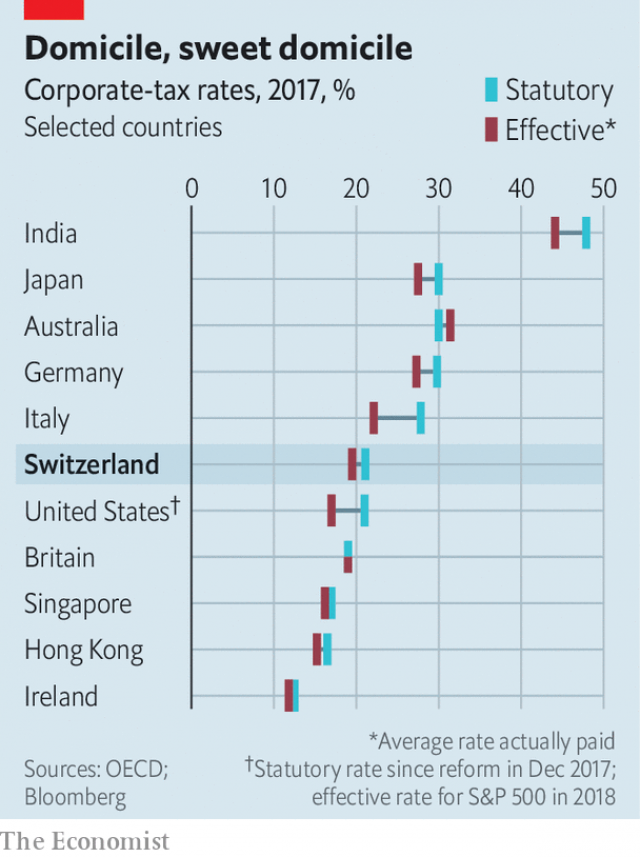

60 of taxable income. Effective Statutory Corporate Income Tax Rate. Japan Tax Profile Produced in conjunction with the KPMG Asia Pacific Tax Centre Updated.

The corporation tax rate unlike progressive income tax is determined by the type and. Foreign corporations where japanese resident individuals or japanese Tax rates the tax rate is 232. Japan corporate tax rate 2018.

At 48 3 In 2018 Corporate Taxes In India Among Highest In The World Business Standard News

Corporate Tax By Country Around The World

11 Charts On Taxing The Wealthy And Corporations Institute For Policy Studies

There Isn T Solid Research Or Theory To Support Cutting Corporate Taxes To Boost Wages

Corporate Tax In The United States Wikipedia

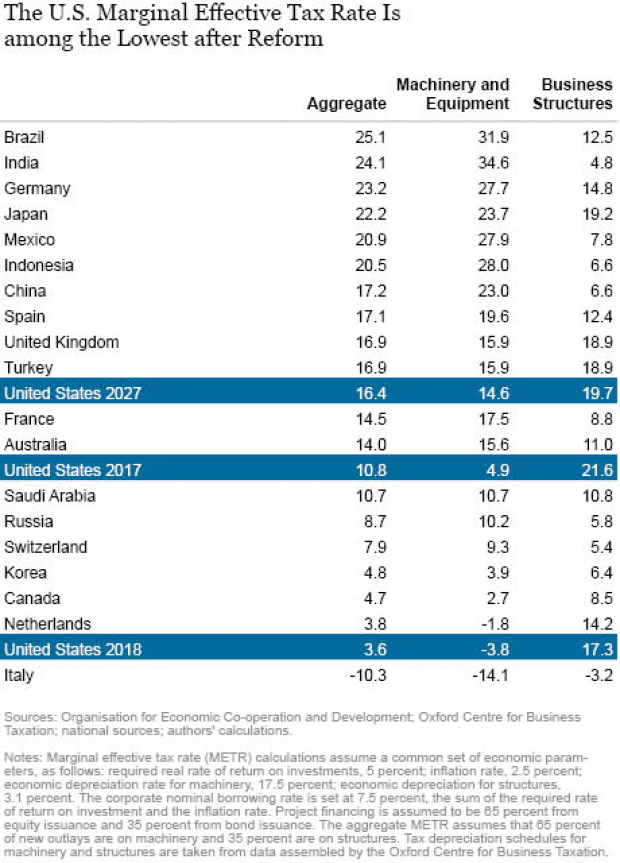

Us Corporate Tax Rates Now Among The Lowest In The World Report The Fiscal Times

Real Estate Related Taxes And Fees In Japan

Corporate Tax Rate In Japan Ventureinq Accounting Firm In Japan Tokyo

How Japan Can Boost Growth Through Tax Reform Not Stimulus Tax Foundation

Japan Sales Tax Rate 2022 Take Profit Org

Changes In Corporate Effective Tax Rates During Three Decades In Japan Sciencedirect

Corporate Tax Rates Around The World Tax Foundation

Doing Business In The United States Federal Tax Issues Pwc

Japanese Corporate Tax At A Glance In Bullet Points

How Important Is Tax Competition To India International Tax Review

How Japan Can Boost Growth Through Tax Reform Not Stimulus Tax Foundation